- Both Barrels

- Posts

- 19th December 2023

19th December 2023

The Dread Sea | Iran’s energy industry getting whacked | Equinor’s huge gas deal with Germany | ADNOC’s spending spree continues

Crew, this will be the last installment of Both Barrels for the year. Time to take a few days off and hang out with the fam.

Thank you for reading. Big love for the holidays. And catch you all in 2024. 👋 🎅 🎉

For the final time this year, here’s what’s what in all things oil, gas, and energy today:

🟥 The Dread Sea

💥 Iran’s energy industry getting whacked

🇳🇬 Equinor’s huge gas deal with Germany

💸 ADNOC’s spending spree continues

➕ plus a rough year for lithium; Fury buys Battalion; mind your feet; Qatar lining up more LNG deals.

Let’s go.

📈 THE NUMBERS

As of 04:30 ET on 19/12/2023. N.B. prices for JKM LNG and uranium can be delayed by a day or two.

Oil and gas prices rose yesterday on the news that BP and others were suspending all shipping through the Red Sea.

The rally didn’t last long though and prices edged back down this morning.

🗞️ WELL-HEADLINES

🗽 North America

Fury Resources acquires Battalion Energy for $450m - the private Delaware-focussed E&P, which produces ~ 12 kboe/d across 40,400 net acres, had been exploring a sale as a cash-crunch had prevented it from developing its asset base.

🏰 Europe

Equinor’s huge gas deal with Germany - the deal, worth ~€50bn, is Equinor’s largest long-term gas contract in nearly 40 years and will supply Germany with up to 129 bcm of piped gas through to 2039. Non-Russian suppliers of gas to Europe are winning big these days to fill the gap in Europe’s energy needs. At least Germany is getting real about energy supply.

Finder Energy by name, finder by nature - the company estimates that its Boaz gas condensate prospect in the UK Central North Sea contains gross prospective resources of 206 mmboe.

Shell fined £1m after worker’s feet crushed - ouch. A worker on a Shell rig in the North Sea got his feet trapped under a sliding step back in 2017.

🕌 The Middle East

Qatar lining up more LNG deals - the gas-rich nation has been busy recently signing long term supply deals with Shell, Total, CNOOC, and others, and more deals with Europe and Asia are “imminent” according to the country’s energy minster. Qatar is undergoing a mega expansion of its LNG sector to increase its capacity to 126 mtpa of LNG by 2027, from 77 mtpa today.

ADNOC spending spree continues - Abu Dhabi’s NOC is about to submit a new bid worth €11.3bn for Covestro, a German plastics and chemicals company. Yesterday ADNOC dropped $3.6bn to buy a majority stake in Fertiglobe, an ammonia producer.

Another Iranian refinery goes up in flames - this time it was a refinery in Isfahan. Last week the Birjand refinery also suffered a giant explosion. Again, no cause was disclosed…

DNO’s Kurdish production recovering - oil production from DNO’s Tawke licence has reached 90 kb/d, up from an average of 26 kb/d in Q3. The licence was fully shut in in Q2 due to the closure of the export pipeline via Turkey (which remains closed), but volumes have been redirected to local markets, albeit at significant discounts (~$35/bbl).

The Isfahan refinery in Iran | “'Once is happenstance. Twice is coincidence. Three times is enemy action”

⛩️ Asia & Oceania

Indonesia’s major gas discovery - Mubadala said an exploration well at the Layaran prospect has uncovered a potential 6 tcf of gas resources, making it one of the largest gas discoveries ever in Indonesia. The company’s CEO said it was a “huge milestone for Indonesia’s and South-East Asia’s energy security."

Prelude’s back - the giant FLNG facility, which is the largest floating structure in the world and is longer than four football (soccer, for our American friends) fields, has resumed operations after several months offline for maintenance. The $20bn flagship facility has suffered several outages since it started production in June 2019, including a fire that led to a full power loss in December 2021

🦁 Africa

Nigeria targeting 2 mmb/d next year - this is the ambition of state-owned NNPC’s new board. Nigeria is currently producing ~1.3 mmb/d of crude and hasn’t hit 2 mmb/d since 2019. Infrastructure security and oil theft have been key hurdles holding back output, said NNPC’s chairman.

Total might be able to help - the major has pledged $6bn of investments into Nigeria’s O&G sector in the “coming years”, with a focus on offshore oil and gas projects (which are less vulnerable to theft and sabotage than onshore facilities).

How to stop the rot?

🗿 Central & South America

Mexico’s richest man building stakes in Talos and Harbour - Carlos Slim has been gradually increasing his interests in the two energy companies through multiple transactions since October. Both Talos and Harbour are participants in the Zama oilfield, one of the Mexico’s most promising energy projects.

🌍 GEOPOLITICS & MACRO

Dread Sea - as Houthi attacks on ships passing through the Red Sea intensify, more shippers, including BP and Evergreen, have said they will halt all shipping through the troubled waters. For many ships, including oil and LNG tankers, this means avoiding the Suez Canal and taking the long alternative route around the Cape of Good Hope. Although about 8-10% of global crude and 8% of LNG supply passes through the Red Sea, Goldman Sachs doesn’t expect the disruption to have a major impact on oil & gas prices.

US and allies to start fighting back - in response to the Red Sea attacks, the US Defense Sec. announced Operation Prosperity Guardian: “this is an international challenge that demands collective action”. The plan involves several countries sending their navies to patrol the sea in an attempt to protect vessels and reassure shippers.

Iran’s petrol stations crippled by cyber attack - ~70% of the country’s petrol stations have been rendered useless by a cyber attack claimed by an Israeli-linked group. The group said the strike was "in response to the aggression of the Islamic Republic and its proxies in the region”.

The long way.

💨 CARBON, CLIMATE, & OTHER ENERGY STUFF

Exxon testing carbon capture powered by fuel cell - one of the key obstacles to carbon capture is the amount of energy the process uses. Exxon is trialing new tech that powers the process using a fuel cell which produces electricity from methane using a chemical reaction. I’m afraid I didn’t listen enough in science class to properly explain how that would actually work.

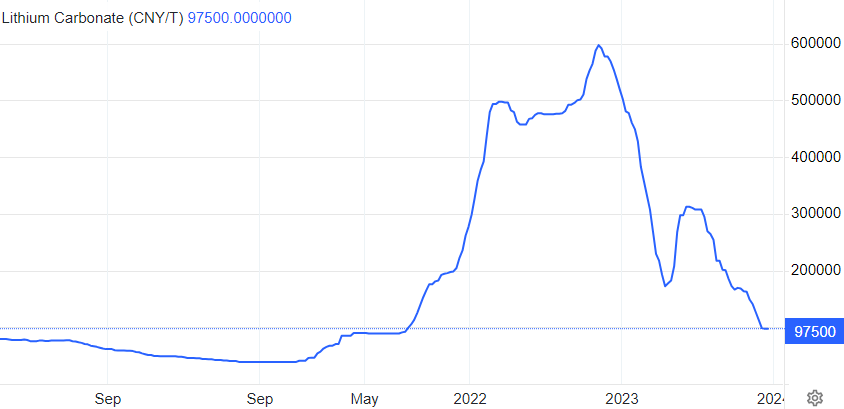

A rough year for lithium - prices for lithium, a key component in batteries, have fallen 80% in 2024 as demand hasn’t kept pace with surging production. This is good news. “Greenflation” is a very real concern over the coming years and a key driver of it will be the rising cost of raw materials needed for low-carbon tech.

Lithium prices have crashed back down to earth

🛢️ BOTTOM OF THE BARREL

The West has two "b" alternatives with the Houthis, which are disrupting global container / energy trade:

"bomb" or "bribe" -- as simple as that.

Neither is great, with lots of collateral damage. But decision time is here as more and more vessels turn away from the Red Sea.

— Javier Blas (@JavierBlas)

12:26 PM • Dec 18, 2023

All I want for Christmas is ⚛️

#MemeMonday#GenerationAtomic

— Generation Atomic (@Gen_Atomic)

4:00 PM • Dec 18, 2023

👋 BEFORE YOU GO

Any feedback, requests, terrible jokes? Please click the poll above or just ping a reply to this email and let rip.

We read every word.

Thanks for reading. See you in a week or so.🛢️🛢️